Just kidding. Don’t get rid of it. And if you don’t like this argument, make a better one. Let’s start.

But now that I’ve got your attention, let’s talk a little history about why Proposition 13 passed in the first place. And by the way — if you didn’t know — Prop 13 capped property taxes at 1 percent, limiting annual assessment increases to 2 percent. Read on, if you dare.

Fix housing by eliminating Prop 13? Build more? They haven’t even fixed the homes that were burned down in the Palisades or Altadena. Prop 13 prevents people from being priced out of their homes. Many have claimed it’s yet another scheme to keep those “evil Boomers in their houses so WE can never own a home,” said here in my best Progressive Democrat voice. And don’t forget: roughly 60 percent of state revenues in the Governor’s budget come from income taxes — 39 percent paid by the 1 percent. Rich people don’t pay income taxes the way we peasants do, yet they contribute well beyond a fair share — maybe not, what say you? The entire progressive argument misses the forest for the trees, okay, John Muir? The fight over Boomers and their property is a sideshow. The real story is the permanent expansion of government and its endless appetite for revenue.

John Muir would be considered a racist by today’s standards, but he liked nature, so he’s good with them. Personally, I find his story quite interesting, and his emotions fit right in with today’s younger folks. Let me ask a question — Santa Monica renter, or perhaps you in Hayes Valley: do you honestly think you’d be able to buy a home and pay heavy property taxes, and that it would somehow be cheaper than your rent-controlled apartment? You think prices would go down? Also, your landlord is being shielded by Prop 13. Take that protection away and they’ll be forced to sell the property you live in right now. What will the new buyer do?

Das boot. Kick you out. The new owner would rather bulldoze the place than subsidize your cheap rent with their investment dollars. Recouping costs at a rent-controlled pace will not happen. They can’t bulldoze in New York because of vertical builds — but Los Angeles? You bet. You may get a small severance. Please see your local ordinances to see if you will even get that.

What would actually happen is this — I predict — you’d be neighbors with a corporate owner or a foreign investor, and at best, you’d still be renting. You will own nothing and be happy. If you can’t afford a home now, you definitely won’t be able to afford one with rising property taxes. Do you see any way these scenarios don’t occur? You think housing costs would go down? Only if ownership required a decade as a California resident. Otherwise, it’s an investor’s heaven.

And as I’ll elaborate later in this series, the 1970s — the Brown family / Reagan burger — was one of the most legislatively destructive periods in California history. This was 1978. Jerry Brown failed to enact much-needed tax reform — back when Californians still held their politicians accountable. That June, Prop 13 took center stage on the primary ballot. Brown “campaigned vigorously against the initiative, but it passed by a wide margin.” That put him in the hot seat for the general election — resist and lose, or pivot and survive? You guessed it. He flopped like a delta smelt on hot asphalt. Vlade Divac taking the foul. (Chick Hearn voice)

Brown suddenly proclaimed, “I’ve been talking about limits since I got here,” and that Prop 13 “has given me new tools.” Jerry Brown — what a guy. As the old Don Rickles joke goes: “He’s one of the most knowledgeable men about politics. You ask him — he’ll tell you. Just go ask him!” It worked. Brown won a second term by over a million votes. Oh, how fun.

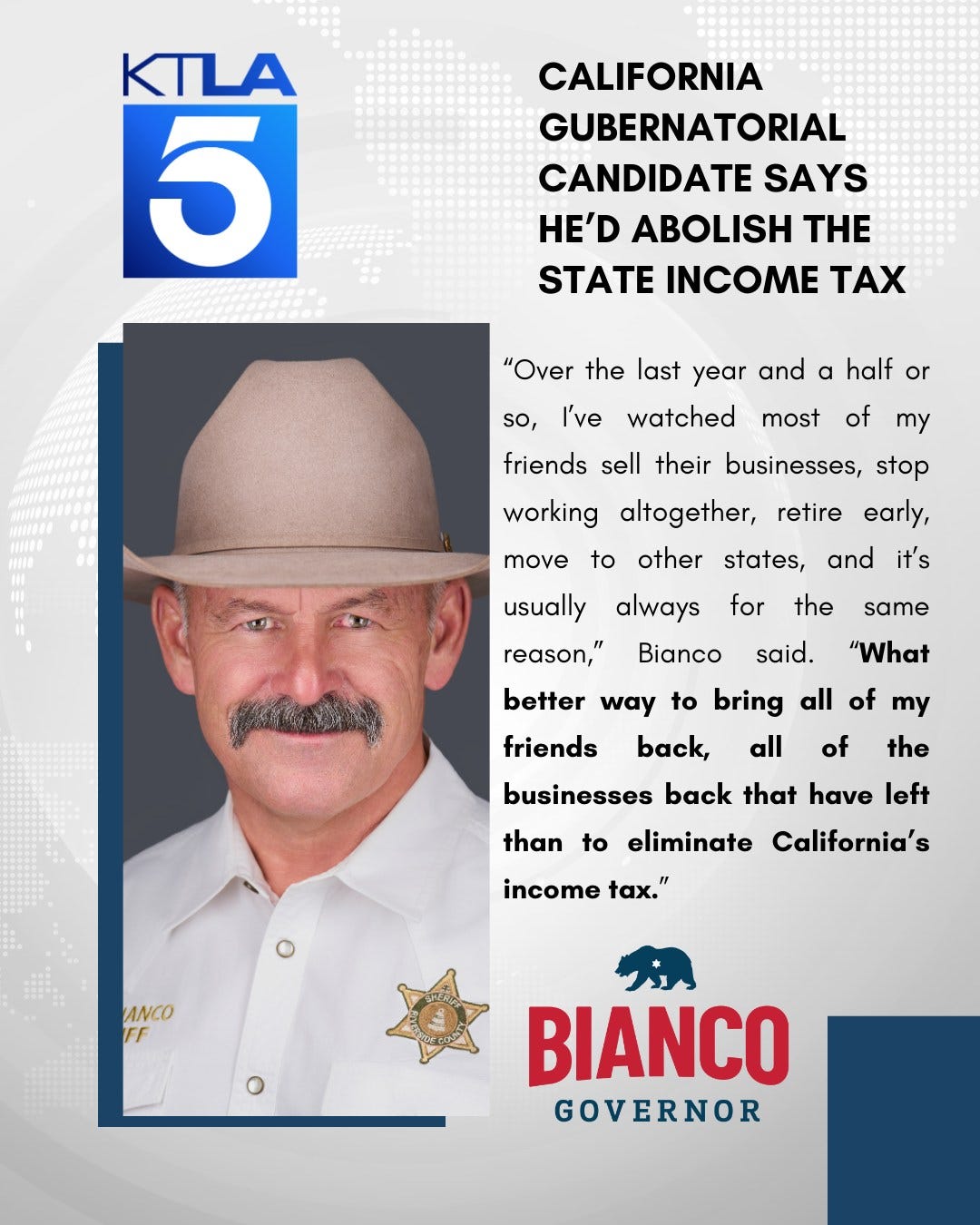

Prop 13 did lead to a massive reduction in government spending — eventually — because if they don’t have it, they can’t spend it. This was my argument when I ran for Assembly: “Abolish the income tax!” Chad Bianco has said he’d do the same — he just hasn’t figured out how yet, per an X space. Right, Legend? You want to checkmate the California state budget and put the Democrat supermajority between a rock and a hard place? Here’s the blueprint. This was tax revolt at its finest. The people had had enough — and they put a stop to it.

Tell me the circumstances don’t sound familiar. Inflation. Taxes are absorbing a growing share of income. Rising government costs with falling satisfaction. Welfare spending is increasing while roads and highways deteriorate. Ineffective leadership in the legislature. Sounds like we’re baking another tax-revolt cake, folks. The difference? Back then, the state had a multi-billion-dollar surplus. Today, Californians have a multi-billion-dollar deficit. How has this not happened already?

Prop 13 didn’t just cut property taxes roughly in half — it forced a two-thirds vote for new taxes at the state and local level. That’s what happens when the electorate wakes up and takes its power back. Yes, per-pupil spending fell after Prop 13. It wouldn’t necessarily happen now because of Proposition 98 — but it probably would. Prop 98 guarantees a share, not outcomes. New money gets absorbed by pensions, bureaucracy, and debt before it ever reaches a classroom. Our classrooms have not shrunk.

And just like everything else in California, there’s plenty of fat on the pig we call the Governor’s budget. Road maintenance? In my part of Riverside County, that appears to be funded by “optional” tolls. Bridges? Don’t talk about bridges in Corona, California. Let’s be honest about what would be cut first — if logic applied: the NGOs, the homeless industrial complex, and high-speed rail.

So why hasn’t a similar revolt happened? Look at the tax burden. In 1978, California’s income tax was roughly half what it is today. Toll roads were rare. Vehicle registration fees were modest. Gas taxes and fees?

As Flea said in Son in Law (1993): “You pick it. I stick it.”

As usual in California history, Prop 13 shifted power from local control to the state — more imperialism from Sacramento and its big brothers, San Francisco and Los Angeles. Spending continued anyway. The state ran roughly a billion dollars over budget until 1981, when Jerry Brown admitted, “The surplus is gone. The cupboard is bare.” Californians kept taxes in check with the two-thirds requirement — until they eliminated it in 2010. Not that it would matter today. California is effectively a one-party state heading into 2026.

Of course, the textbooks cry: “But the niños!” — sorry — “the niñx!”

By 2009, California ranked 47th in the nation in education. The excuse? Not enough money because of Prop 13 — you selfish Boomer bastards. The reading scores? That’s the good news. Only 37 percent of K–12 students are at grade level in math. What does the Alta Historian say?

I’ll borrow from Animal House: “Thank you sir, may I have another?”

I have an eye-dee-er — let’s elect Jerry Brown again. California did just that in 2010.

Californians are taxed from every direction imaginable. Collapse is coming — not because we lack revenue, but because the state refuses to manage it responsibly. And to those eyeing Boomer property: you’re being distracted. You are the target. Decades of tolls, gas taxes, sales taxes, income taxes, and property taxes still lie ahead. The state would much rather a corporation own your home. Corporations don’t default — and when they do, California is happy to seize. That’s not capitalism. That’s Fascism — government and corporations working together.

Ask Palisades residents how efficient the response was a year after the fires. Ask Altadena. If I were paid per word listing government failure after disaster, I’d be as wealthy as Gavin Newsom — on a public salary — living in a $9 million gated home, kids in private school, while literacy sits below 50 percent. But hey — the Boomers.

Maybe someday, Progressive Democrats, we can have a tax revolt together. Because if money were the solution, California would have solved homelessness decades ago. High-speed rail. Literacy. Math. Infrastructure. Water storage. Crime. Fires. Human trafficking. You know — the usual.

I digress. Fourth-largest economy, tho’.

You ready for the truth? “You can’t handle the truth!”

If you knew California history, you’d vote differently. Not Republican — they don’t deserve your love either — but differently. You’re being fleeced. “Hi, I’m Chucky. Wanna play?” This isn’t Child’s Play. The truth is harsher: the whole carrot farm will never satisfy this litter of bunny politicians.

The die is already cast.

P.S. If nobody ever reads this, let this stand as a primary source of the moment many Americans realized something fundamental was breaking, and that the choice to act still existed. And if the republic collapsed, I’m sorry, I tried. :’ (

Bibliography | Notes

Jones, Carolyn. “After Years of Decline, Smarter Balanced Test Scores Climb.” CalMatters, October 9, 2025. https://calmatters.org/education/k-12-education/2025/10/smarter-balanced-test-california/.

Rawls, James J., and Walton Bean. California: An Interpretive History. 10th ed. New York: McGraw-Hill, 2012. Pages 439-440, 455, 506-507.